ATO assessment of eligibility of taxpayer activities

NFPs need to get ready for new return From 1 July 2024, non-charitable not-for-profits (‘NFPs’) with an active Australian […]

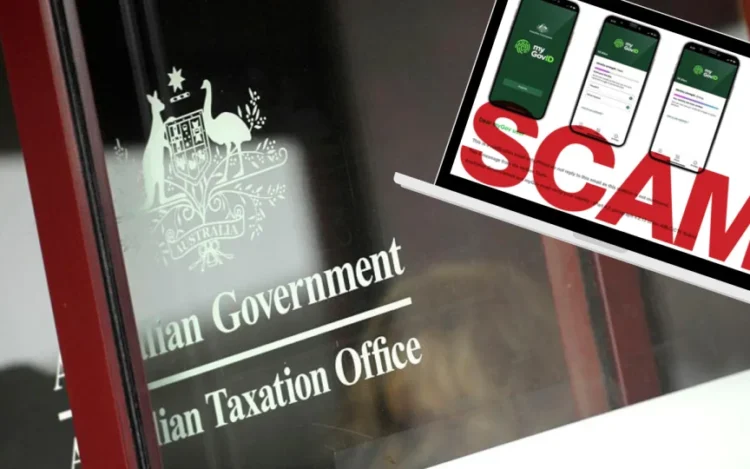

Warn alarm–fake MyGov scam, super access and false invoicing

Government warns of ‘malicious’ MyGov scammers The Government says the ATO or MyGov will never send an email or[…]

Use our small business benchmarks to improve your business

Find out how your small business compares to others in your industry. We’ve updated our small business benchmarks for 2021–22. The[…]

ATO warning regarding prohibited SMSF loans

Loans to members continue to be the highest reported contravention of the superannuation laws that the ATO sees in[…]

Avoiding common Division 7A errors to compliance with their additional tax obligations

Private company clients who receive payments, benefits or loans from their private companies need to ensure compliance with their[…]

Reminder of December 2023 Quarter Superannuation Guarantee (‘SG’)

Employers are reminded that, in relation to their SG obligations for the quarter ending 31 December 2023, the due[…]