You are taking big risks if you use an unregistered preparer to:

- prepare and lodge your tax returns and statements

- provide you with tax advice

- represent you in your dealings with the Australian Taxation Office (ATO).

Tax practitioners include tax agents and BAS agents. They must be registered with us to provide tax agent services, BAS services or in some cases, tax (financial) advice services for a fee or other reward.

What are the risks?

Listed below are some risks that you face if you use an unregistered preparer to provide you with a tax agent service (which includes a BAS or tax (financial) advice service):

Sharing your myGov account details puts your personal and financial affairs at risk!

The TPB is investigating several cases involving unregistered preparers posing as legitimate registered tax practitioners, who lodge tax returns on behalf of their clients. These unregistered preparers operate, often by accessing the myGov accounts of their clients and lodging their returns through myTax.

Please note that myTax should only be used by a taxpayer to lodge their own tax return, and is not an approved lodgement channel for registered tax practitioners. A registered tax practitioner also does not require access to their client’s myGov account to act on their behalf.

As such you should take care not to share your myGov password with anyone. Sharing your information (such as your myGov password) with an unregistered preparer puts your personal and financial affairs at risk.

Be protected by using registered tax practitioners

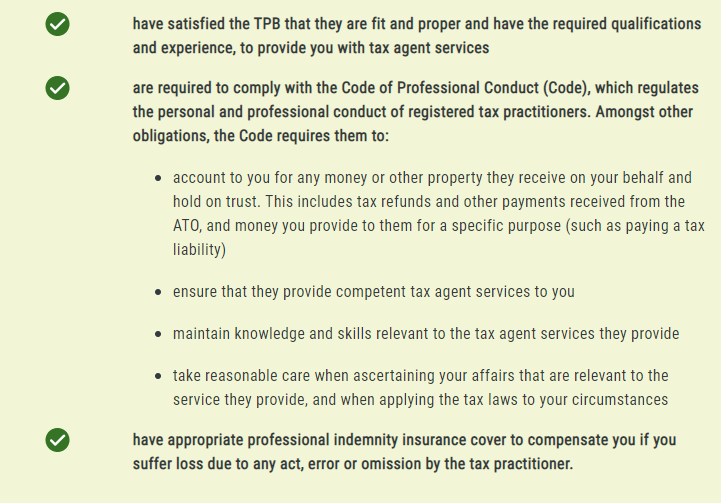

We protect consumers of tax agent services by registering and regulating tax practitioners, so they meet the appropriate standards of professional and ethical conduct.

Check the TPB Register or look for the Registered tax practitioner symbol to ensure your tax practitioner is registered.

Using a registered tax practitioner means they:

Source from TPB